Want to Achieve Your Money Goals?

Obviously, you do, we all strive to achieve our money goals.

The question is- why is it so hard to achieve our money goals?

One of the issues is, people prolong getting started by waiting until a date on the calendar (typically January 1st) to “officially start”. There really isn’t a good reason to delay something that can be started today, especially when it comes to money. Ideally you should always be working on improving your money position.

The other issue is generally the goals that we set aren’t specific enough and don’t have the steps required to achieve them attached. Look, I’ve been there and tried that AND it doesn’t work. Without specific goals and actionable steps to achieve, we end up right back at square one.

It goes without saying that setting money goals is an important part of managing and growing your money. So why not set ourselves up to be successful as possible?

I’ve come up with a 6-step plan that has really helped me make great progress with my money goals. This plan creates the framework to achieve your goals AND you don’t have to wait until a date on the calendar to start, you can start ANYTIME.

Here it is.

STEP 1

To get started I look at the last 6 months of my money transactions to get a sense of where I am. You must know where you are BEFORE you can know where you are going. Here are the things that I review:

- Income

- Savings

- Expenses

- Debt

- Credit

I assess whether or not:

- My income is enough to cover my expenses

- I’m paying down my debt effectively

- I’m saving

- My credit is in a good place

Based on where I am, I now have a sense of the areas I want to focus on.

STEP 2

I start mapping out my goals using electronic post it notes. I use electronic post it notes so that I can visually see them every time I log on to my computer. The one thing I really like about using electronic post it notes is that I can easily change them or update them.

I start with 4 big electronic post its and label them into 4 broad money categories:

MONEY KNOWLEDGE- What will I learn this year?

MONEY INFLOW- What are my sources of income and how will I increase them?

MONEY OUTFLOW- How will I streamline the money outflow to keep more of my money?

MONEY FOR THE FUTURE- What will the next 5, 10 or 20 years look like and how will I start preparing for it today?

When visualizing growing and managing your money, these areas focus on helping you continuously move forward and make progress. This method covers all areas of money and keeps them grouped and organized.

STEP 3

Next, I breakdown the broad categories into 3 smaller subcategories. Subcategories may vary by family or individual so these are just some suggestions to help you get an idea of what should go in each broad category.

MONEY KNOWLEDGE

This category is for learning more about money. We should always be focused on increasing our knowledge to help us continue towards the goal of growing our money. Ways to increase your knowledge include reading money books, watching videos and/or working with a personal finance expert. Some examples of subcategories are:

Real Estate Investing

Tax Advantages

Retirement Funding

MONEY INFLOW

This category is for growing our income, ideally, we should have multiple streams. Income strategy is an important part of your financial plan. It’s helpful to break it down into the following subcategories.

Main Source of Income

Other Sources of Income

New Source of Income

MONEY OUTFLOW

This category is for minimizing the money that goes out, the expenses and debt. Streamlining expenses is key in keeping more of our money. The subcategories here are broken down by expenses necessary to run the household, debt and expenses for our lifestyle such as shopping, hair and nail care, gym memberships etc. Breaking them down this way helps to separate necessities vs wants.

Household Expenses

Debt

Current Lifestyle Expenses

MONEY FOR THE FUTURE

This category brings the future into today so that we can do something about it now. It gives us the opportunity to prepare for the future life we want. It is helpful to break it down into the following subcategories.

Savings

Investing

Future Lifestyle Expenses

STEP 4

Once I have the subcategories established, I identify one specific goal from each subcategory that I would like to work on. Don’t worry the goal is not to try and accomplish all 12 goals ( 4 broad categories times the 3 subcategories) at once, having too many goals to focus on at once can be overwhelming and can simply cause us not to do anything. This is just to build the framework for you to choose which ones you will work on during a specific period. It’s ok if you don’t have a goal for every subcategory right now.

STEP 5

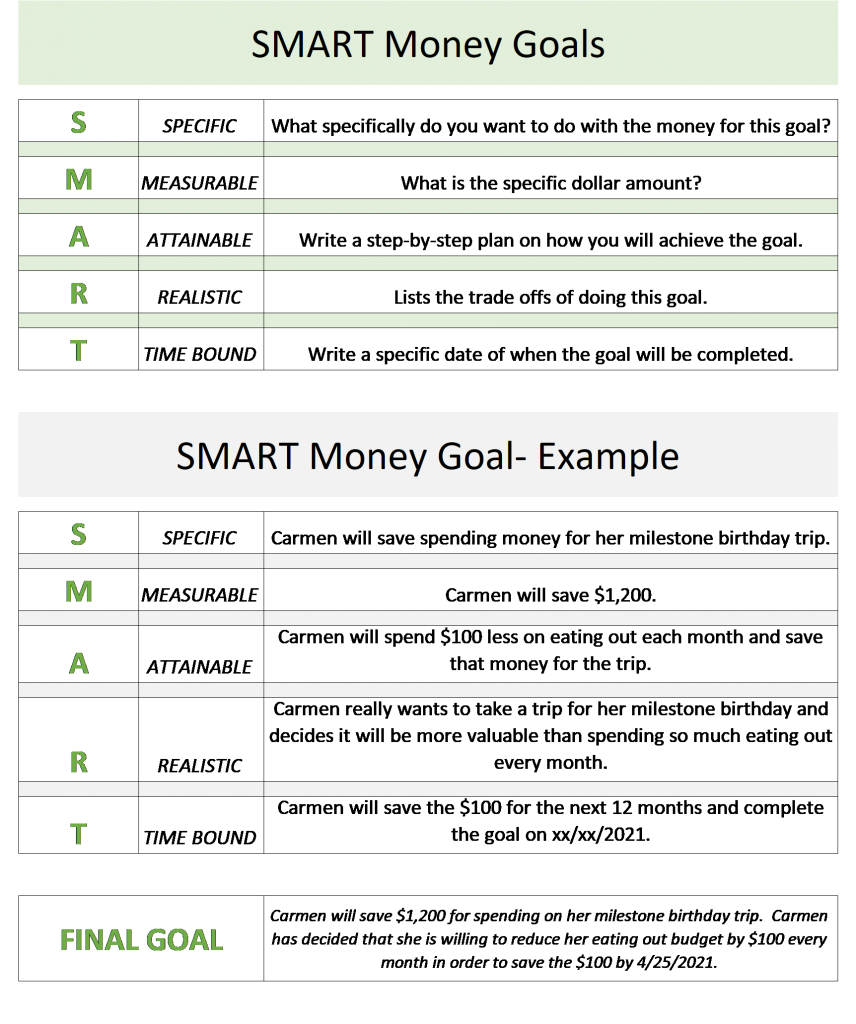

Next, I select 2 or 3 goals to start with and write them in the SMART goal format.

- Specific

- Measurable

- Attainable

- Realistic

- Time Bound

Here is an example:

To help I’ve created a SMART goal template for you to use. Grab a copy here.

STEP 6

After creating the 2 or 3 SMART goals, I then write down the necessary actionable steps for each goal required to complete it. This is a critical step because a goal without actionable steps is useless. Writing down those steps now allows you to add them to your calendar so that you can make sure you stay on track.

I repeat STEPS 5 & 6 until I’ve completed the goals. Keep in mind you will have to review your money status to make sure your goals are still relevant.

That’s it, that is the 6-step framework for creating and planning money goals.

What’s one goal you’re looking to accomplish currently?