Where are your financial documents currently stored?

Would you be able to locate them should you need to?

Organized and properly stored financial documents are an important part of any money management system. Not being able to locate your financial documents when needed can be very costly. Take for instance not having a system to organize your mail as it comes in and using my FORMER system of “let it pile up and sort through every 2 months”. With this unorganized method, you could easily miss a bill and incur late fees or have a 30 day late pay added to your credit report in turn lowering your credit score and raising your borrowing costs. Or worse, throw away an unexpected check. (Yes, I have done both!)

Imagine these examples, you receive a bill for a loan that you paid in full years earlier and can’t find the documentation to show your final payment. Or your laptop is stolen and in order for your insurance to replace it you need the receipt of purchase. Or your refrigerator goes out and you are not able to locate the warranty that would cover the repairs. In these instances unorganized/missing financial documents could end up costing you unnecessary additional money.

Financial documents aren’t just related to physical items, there are health related financial documents as well. What if you suddenly became ill or worse passed away? Would your family be able to locate your financial documents in an emergency? Or would they be scrambling trying to figure out where and if there are any documents available– making a stressful situation even more stressful. As you can imagine, trying to get access to health directives or life insurance policies when someone is incapacitated or deceased is very challenging.

Now that I have gotten your attention about the importance of organization, let’s talk about the documents you should have on hand and methods to store them.

Financial Documents to Have Available

- Life Insurance Policies

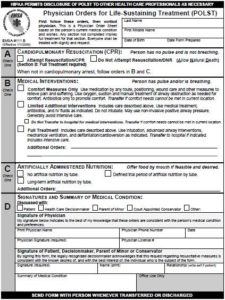

- Health Directive

- Wills, Trusts etc.

- Bank statements, investment statements, monthly bills

- Receipts of big purchases

- Deeds, Titles

- Warranties, User Manuals

- Loans

Other Life Documents to Have Available

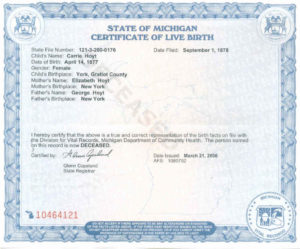

- Birth Certificate

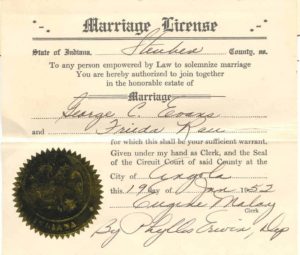

- Marriage License

- Divorce Decree

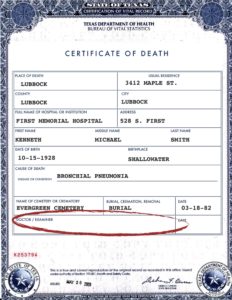

- Death Certificates

How long to keep the documents varies by type of document but for now let’s talk about how to store them. No matter how you store them, the goal is to have them easily accessible whenever you or your family needs to access them. You can store the documents physically or electronically, it’s generally a matter of preference. Physical storage would require some type of filing system or cabinet, preferably disaster proof. Electronic or digital storage is paperless and requires you to convert your current paper documents to digital files. Personally I use a combination of both methods. I like to keep a physical copy of some of the life documents mentioned above.

To help you in determining which method(s) to use here are some things you should consider.

Physical Storage Considerations

Physical Storage Considerations

- Physical storage access is restricted to one location.

- A disaster could destroy the documents if not stored in a disaster proof container.

- How will you organize the files?

Electronic Storage Considerations

Electronic Storage Considerations

- Electronic storage is easily accessible at multiple locations.

- How will you organize your files electronically?

- Will it be secure?

- Will additional equipment be needed to convert to electronic/digital storage?

- Should you use a storing service (fee associated) or store them say in the cloud, on your hard drive or on a USB device?

No matter which method you choose you will have to do regular maintenance. Remember the goal is to have your documents organized and easily accessible.

What is your preferred method of document storage? Leave your reply in the comment section below.